Earlier in the year, I wrote an article breaking down 2012 Topps Series 1 from a case breaker's perspective and the possibilities of, potentially, making a little money. I later followed that article up with the actual results from both myself and other breakers.

Earlier in the year, I wrote an article breaking down 2012 Topps Series 1 from a case breaker's perspective and the possibilities of, potentially, making a little money. I later followed that article up with the actual results from both myself and other breakers.

Throughout the year, I have seen more people venturing out to try case breaking or, as some call it, 'ripping and flipping.' I have also received dozens of inquiries on how one might get started.

Another trend I have seen is that returns have fallen sharply. It wasn't just me. I heard similar thoughts from others. Even though 2012 was a great year with some fantastic baseball products and rookies, for me, all but two products saw decreases in profits per case due to rising costs and other factors.

With that in mind, I want to follow up on both articles with some observations and tips while also taking a look at that latest base Topps release, 2012 Topps Update Series Baseball.

On a side note, I do want to state that I am a collector too. For many of us, cards are not about profits and losses. While this article focuses on that side of it from a case breaker’s point of view, it is not what makes a product a good one or a bad one. That is up to each individual based on their preferences and collections. The overall quality of a product should also be based on the content and value a product provides. But for this piece, I will focus more on the case breaking side and the direction that it may be headed.

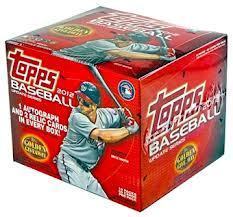

Before diving into some numbers and observations, I want to say I like 2012 Topps Update Series Baseball. I know for some case breakers they don't look forward to Series 2 or Update, but as a collector I enjoy both since they complete the year's set and offer continuity throughout the baseball season.

With Update, I enjoy the All-Star Game focus not only in the base set but in the relic set. It offers unique memorabilia swatches and patches, plus some of the best players of the year since they are, well, All-Stars. Also, Update is full of rookies and traded players. Even if we may have seen many rookie cards of these players already in other sets, it is always nice to have one with the flagship design.

I really enjoyed the addition of the Hall of Fame Plaques that replaced the World Series Pins from Series 1 and 2. Although some collectors grew tired of the manufactured relics by the time Update rolled around and sales were down quite a bit on them, it was refreshing to see the new plaques. I think many could not truly appreciate them until they actually got hold of one. The plaques are some of the best manufactured relics in a long time.

I really enjoyed the addition of the Hall of Fame Plaques that replaced the World Series Pins from Series 1 and 2. Although some collectors grew tired of the manufactured relics by the time Update rolled around and sales were down quite a bit on them, it was refreshing to see the new plaques. I think many could not truly appreciate them until they actually got hold of one. The plaques are some of the best manufactured relics in a long time.

Also, Topps brought back the popular serial-numbered gold-bordered parallel set. Since they were missing from Series 1 and 2, Topps included all three series in one go, making it a 990-card set. I'll have more on this later.

Overall, 2012 Topps Update Series Baseball was a solid release. However, for some case breakers, it did not turn out well. Most reported returns as high as $125 per case in profit. Some ended up losing as much as $125 per case. Of the breakers I spoke with that opened at least six cases, they averaged slightly better than break even.

While Update is typically not as strong as Series 1, there were some reasons why some may not have fared as well as they had hoped. Base Topps is considered by most the best possibility for return simply because it is low risk. The case prices are on the low end (although jumbo boxes can be pricier than other sets like Topps Heritage). Base Topps also has the widest collector base of any release. Of course, that means it has higher production numbers than other releases.

Case breaking never has any guaranteed hits, but why was there such a downturn with 2012 Topps Update Series Baseball?

Content, Checklist, and Case-Breaking Value

Every release is different and, often, there are unknowns to a product’s checklist prior to it being released. However, that does not mean the product cannot be studied and researched.

Often when a new product’s information is released I hear all the buzz and excitement about new additions. New additions are nice, but often what is missing is overlooked. New additions typically mean that something is being replaced or altered. This can impact a product's success as far as recouping one's costs.

In the case of 2012 Topps Update Series, there was no wrapper redemption. Also, the autograph checklist was much smaller than Series 2, which had numerous retired and Hall of Fame players. These, obviously, can add to the bottom line.

Furthermore, the code program has been the same since Series 1. Without any new content, the demand for code cards has continued to decline.

Finally, it was great to see the return of the serial-numbered gold-bordered cards. However they had to replace something. As a result, there were less insert cards and subsets to build larger master sets larger. Thus, Update was the smallest master set (base set plus inserts) of the year. This led to much cheaper value from a master set but it still took at least one case to build. Sure the set had less cards, but it was no less difficult to make as far as the number of packs were concerned. So while it was nice to have the Gold cards back, again, it replaced something.

Finally, it was great to see the return of the serial-numbered gold-bordered cards. However they had to replace something. As a result, there were less insert cards and subsets to build larger master sets larger. Thus, Update was the smallest master set (base set plus inserts) of the year. This led to much cheaper value from a master set but it still took at least one case to build. Sure the set had less cards, but it was no less difficult to make as far as the number of packs were concerned. So while it was nice to have the Gold cards back, again, it replaced something.

The value of the Gold cards decreased by up to half. By having all 990 cards included, it flooded the market. Whereas, typically, a collector may spend $300-$350 per 330-card gold set spread out over each series it is a little more difficult to do it all at once and spend around $1,000 for the 990-card set. Besides that, some collectors moved on to the Golden Moments sparkle parallel set instead when Topps elected not to make the traditional gold set. All of these items play a factor and are good to know ahead of time.

Looking at the early information for some products in Topps' 2013 baseball lineup, definitely look at what is new, but also look at what is missing.

There is no information on a wrapper redemption for Series 1. Even if there is one announced, will it have the household limitations again, thus shrinking the value of the program from a case breaker's point of view. Those who break a lot of product cannot redeem them all or, possibly, even sell them all.

Also, how will the new code program be received? How many cases will be produced and what does that mean for the odds of the tougher pulls? What short prints will be included? Will the legends return? The same questions should be asked about each product. Topps Heritage has some nice features, but what has changed? It is very important to study as much as you can before making a commitment to a release.

A recent example is Gypsy Queen. It debuted strongly in 2011, but as far as case breaking was concerned, it fell off the map in 2012. It had many changes and lots of content removed, even with a significant increase in production. Again, this does not mean the Gypsy Queen was not a good product or collected widely, but that changes made to content, checklist, and break value were altered much from the prior year.

Number of Breakers and Cases Opened

2012 Topps Update Series Baseball had the most bulk breakers I have ever seen. Typically there are four to six people that may break 15+ cases of a base Topps baseball release. This time there were 13. Of those, four opened 35+ cases. This led to more cases being opened at the time of release rather than it being more spread out. This creates over saturation in the market.

This is nothing new as it does happen often. The difference was the sheer volume of heavy breakers. Four informed me that this was their first case break. Sometimes, less is more.

Those I spoke to that opened four to six cases saw per-case profits that were higher than those that did higher volumes like 20 or 40 cases. In fact, the majority of losses I learned about came from the bigger breakers.

A few observations about that. First I would suggest starting small. There's a lot of time and resources involved. Also, if you have not built up your name or have buyers in place, it can cause issues. Every product is different for me. I base my orders off of the demand I have. Whatever I pre-sell direct and on eBay I calculate how many cases will be needed. I also add a little extra for some growing room or surprises.

Second, if Case #1 costs a breaker $500 and yields $250 in sets and inserts plus $350 in other content. By Case #10 it still costs the breaker $500, but the sets may only yield $200 and the other content that you have (doubles, triples, quadruples, etc) is only at $250. You have diminishing returns on each passing case. I have done my own studies on what my first 20 cases brought in compared to my final 20 cases. Often, the results are ugly, especially for the amount of work it take. For me, the extra cases were necessary because of orders I took or goals I had on completing tougher sets for customers.

This leads me to my final observation. Typically in the past, there have been less than a handful of collectors that have paid a premium for the tougher sets in flagship Topps such as the serial-numbered Gold cards. Even though the cards are numbered rather high (numbered to 2012 this year), there are not typically been more than a handful of complete sets offered on eBay each series. Because of the low supply, the sets would sell fast and at a high-dollar rate. As the number of bulk breakers has increased, it has increased the number of the more difficult sets available. The number of completed sets available is increasing but the number of collectors buying them aren't. For me, a lot of collectors buying these tough sets do so direct and not on eBay. As a result, eBay is getting flooded with sets with an almost non-existent market for them.

Some collectors like to build the sets themselves. Others simply can’t afford the premium prices and wait for the prices to drop, hoping they can land a set cheaply. Because of the increased availability, now they can. This is not a bad thing for collectors. But from a case breaker's standpoint, it has decreased the value of the tougher sets. More complete sets are available. Ultimately, this may hurt future values of the cards themselves. This is simple supply and demand.

Time of Year

Typically, the later in the baseball year, the more products tend to produce less than favorable results when it comes to case breaking. This does not mean that there are not quality, highly anticipated products. They just might not be case-break worthy. Between summer travels, other sport seasons beginning, the type of products being released, and repeats of the same players throughout the year, it tends to become tougher to recoup costs.

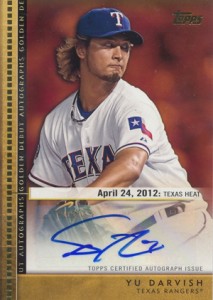

Products in the latter half of the year tend to be more rookie-, prospect- and hit-focused. Most rookies take years to develop in the marketplace, if they ever do. Whereas hotter rookies tend to cool down throughout the year, even if they play well. This is because there have been numerous rookie cards from earlier in the year. Looking back at early Bryce Harper and Yu Darvish autographs, both had cards that would sell for $500-$1,000 or higher. Both can be had for under $100 in 2012 Topps Update Series Baseball. So there is value lost. And if the rookie does not perform? We know what that can mean.

Products in the latter half of the year tend to be more rookie-, prospect- and hit-focused. Most rookies take years to develop in the marketplace, if they ever do. Whereas hotter rookies tend to cool down throughout the year, even if they play well. This is because there have been numerous rookie cards from earlier in the year. Looking back at early Bryce Harper and Yu Darvish autographs, both had cards that would sell for $500-$1,000 or higher. Both can be had for under $100 in 2012 Topps Update Series Baseball. So there is value lost. And if the rookie does not perform? We know what that can mean.

Another factor about the latter half of the year is that by summer families may be busier and many collectors may have gotten the cards they wanted for the year of their player or team. Plus, with other sports kicking into gear, some collectors shift their attention to picking up the first cards from other sports. This is just one possible reason we see baseball products not perform as well for case breakers as the year progresses.

Hours Involved

One major factor that often is overlooked is the amount of time it takes to do a case break, even in a smaller quantity. I tracked the total 'man hours' it took for the first time during my 2012 Topps Update case break. I try to have everything done within two-and-a-half to three weeks with a break of this size. This often means working as late as 4 AM some nights and having one or two people helping me during most evenings and weekends.

For 2012 Topps Update Series, I opened 48 jumbo cases which equals 2,880 packs and approximately 144,000 cards. It took 40 hours to open all the packs, separate the inserts from the base cards, and sort them into basic piles. It then took nearly 95 hours to scan the single cards and list the cards and sets on eBay. Another 115 hours was spent on packaging and shipping. A whopping 280 hours was spent on sorting 354 base sets, 40 master sets with inserts, over 100 other insert sets, dozens of parallel sets, and the hits and short prints. Finally, another 35-40 hours was spent answering emails, tweets, and personal messages. Well over 550 'man hours' (probably closer to 600) went into the 48 cases.

Some that track their profits and losses by the hour may not like that. For others, it is worth it considering the fun it provides. It all depends on your goals and priorities.

Long ago I said that I wanted to break cases if I could have fun, break even by the end of the year, and grow my personal collection. But I have had to sacrifice a lot family time. As I grow older and my children grow up, it makes me look at a bigger picture. The amount of time that goes into a successful break is immense. For a break to go well and to meet the demands of your customers (and eBay policies), it can be stressful, require time off of 'real' work and take you away from daily life events.

Regarding the hours I tracked, it accounts for all man hours from October 1 when I began pre-filling Turbolister with the Topps Update checklist, up until October 23 when the last sets shipped. I also added in the few hours of listing pre-sell sets in late-September and the emails I sent to secure direct orders prior to the product arriving. It does not factor in the time since October 23 to answer emails or deal with the small number of non-paying bidders and relistings. One time factor not included was the hours spent on tracking all sales and costs on spreadsheets for records, research and taxes.

The time it takes is different for everyone. Some sellers like to move all their sets in bulk or even unsorted. Others do not list as many single cards, but list cards in lots instead. I tend to have over 1,000 listings for a big break. This isn't just because of my volume, but to offer a variety of choices for different collectors. It also helps me gain more exposure.

What’s Next?

Case breaking can be enjoyable, but it is not going to make anyone rich. The margins are small. In fact, many products have long histories of losing money. The crumbs are small if there are any to be had at all. This is why it is important to find a place where you not only enjoy what you are but won’t lose a small fortune in the process. Find your niche.

Many case breakers found a niche through group breaks that have really taken off over the past few years. Changing the way you sell or finding new avenues or customers to sell to helps. Other breakers have ventured to other sports or even entertainment and non-sport products. They have reported much higher returns than they ever saw with baseball.

Typically, there are very few other sport products that ever produce profits for large breakers. But there are a variety of manufacturers and products being made so it may be worth a small chance to try something new. This year, breakers reported good success with products in golf, wrestling, soccer, and the Olympic-focused releases.

Within the realm of entertainment cards, there are so many options. Many releases in the last year have been as hot as ever. Some of these releases are seeing box prices soar. At the same time, added content and value has made the case-breaking side less risky. Some breakers have reported 200-300% returns over the past two years within some non-sport breaks. This is far higher than any baseball or other sport products. Just be sure to do some research before jumping in.

I have also heard of some breakers getting into the toys and collectibles market. Graded toys, LEGO, Star Wars, and other toys remain hot. Many are climbing in value. So, it would seem, there are plenty of opportunities out in the collectibles marketplace.

2013 brings many questions. I am typically excited for the next year to get started. But, for the first time in years, I am unsure. I normally would encourage folks to give it a try. Right now, I can't, especially when veteran breakers are struggling and moving on to others options.

2012 saw a great rookie crop with the likes of Mike Trout, Bryce Harper, Yu Darvish, Yoenis Cespedes and others performing well. Will we see that again in 2013? For now, there does not appear to be a strong class that could add case-breaking value.

Also what changes to eBay policies and listings will occur in the spring update? Currently, the newly updated duplicate listing policy looks to really slow down quantity case breakers and result in less revenue.

How will the postage increase in January impact costs and will postal delivery days be cut? What changes in legislation may affect the tax laws for both income and possible sales tax? What changes will manufacturers make to their distribution policies and methods? Will it allow for everyone to receive product on the same day, for the most part? Questions like these and others have me unsure about case breaking. Seeing recent results also adds to my curiosities.

Wrap-Up

I'm not here to paint a bleak picture for case breakers. Rather I want to show how much work is involved and report that it has become more difficult to recoup your initial costs. Busting wax can still be a lot of fun. It's just less so when you are losing quite a bit of money and taking up a lot of time. This is a market. Like most, it is cyclical. Good results come and go, so we must go through the down times too. It may be time to sit back and wait or perhaps branch out and study other alternatives.

If you are busting cases to grow your collection, it may be a good time to stop and pick up singles and sets instead. With so many breakers right now, it is more of a buyer's market than a seller's. Plus, you will be able to pick and choose what you want easier.

If you are looking to break cases and possibly make a little bit of money from doing so, it is possible but, usually, not probable. If you are just getting into case breaking, you definitely will want to research products and data, and talk with experienced breakers to get their insights. No product, year, series, or sport is the same, so it is key to know what possibilities lay ahead before choosing to break cases to profit from them.

You may also want to take a look at my 10 tips of case breaking. In the end if you are breaking for enjoyment, don't stress about the money too much. Start small, build a name, and gain experience before getting in too deep. There will always be products and niches where the risk may be lower.

If you do it right and put in the time, you can be successful even if margins are tight. There are no guarantees and if it is too stressful or not enjoyable then it is probably something you will not want to do at the case level.

Shop with brentandbecca on eBay:

|